- Order Online or Call

-

(888) 474 - 9966

(888) 474 - 9966

-

-

Mon - Fri 9:00am - 3:00am EST - Se Habla Español

Sat - Sun 9:00am - 6:00pm EST

Inflation Reduction Act: Now Is the Time to Upgrade Your HVAC System

Have you been thinking about getting a new heating and cooling system? Great news – there’s never been a better time to modernize!

Why? Because the Inflation Reduction Act of 2022 (IRA) can help you get thousands of dollars back for installing HVAC systems that meet their high-efficiency standards.

The financial rewards come in the form of point-of-sale rebates and tax credits, and are designed to encourage more people to switch to all-electric heating and cooling equipment that will reduce energy consumption and result in lower utility bills.

How Does It Work, and How Much Can You Get?

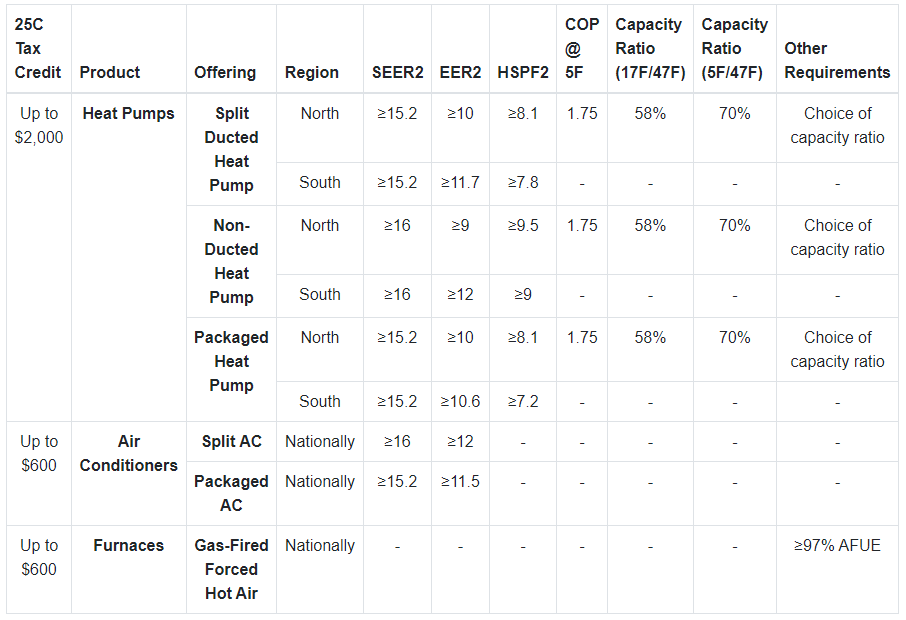

Purchasing and installing high-efficiency HVAC equipment combined with where you are located will determine what you are eligible to receive. The chart on this page can help you understand those requirements. Call us to go over which eligible IRA products are the best fit for you and your home.

One of the features of the Act is that it amends and extends numerous existing incentives, as well as creating new ones

Energy Efficient Home Improvement Credit (25C)

This part of the Act raises the tax credit for products on the highest efficiency tier from 10 percent of installed costs all the way up to 30 percent. In 2033, the percentage drops to 26 percent, and in 2034 to 22 percent.

For eligible furnaces and AC units, this can result in a credit of up to $600.

For eligible heat pumps, that credit can jump up to $2,000.

Also, the existing heat pump credits of up to $300 are retroactive for any equipment that began operating after 12/31/21.

HOMES Rebate Program

Homeowners installing high-efficiency equipment may be eligible for a rebate of up to $8,000 depending on IRS income requirements and modeled energy savings. Additionally, under the update, qualified home energy audits now count as eligible improvements and can earn you up to a $150 tax credit.

High-Efficiency Electric Home Rebate Program

After your state applies for funding and sets up its program, you can become eligible for rebates (based on your income) for:

All-electric ENERGY STAR heat pumps - up to $8,000

Air sealing, insulation, and ventilation - up to $1,600

Electric wiring - up to $2,500

Electric Load Service Center - up to $4,000

Households are allowed a maximum rebate of $14,000

Note that it is not possible to combine the HOMES Rebate Program and the High-Efficiency Electric Home Rebate Program.

Utility EcoRebates

Besides these national programs, many areas also offer their own rebate programs. Research what local savings may be available to you.

Flexible Financing

Many dealers utilize monthly payment plans that can be designed to fit your budget. Unsure if you qualify? Speak with a tax professional.

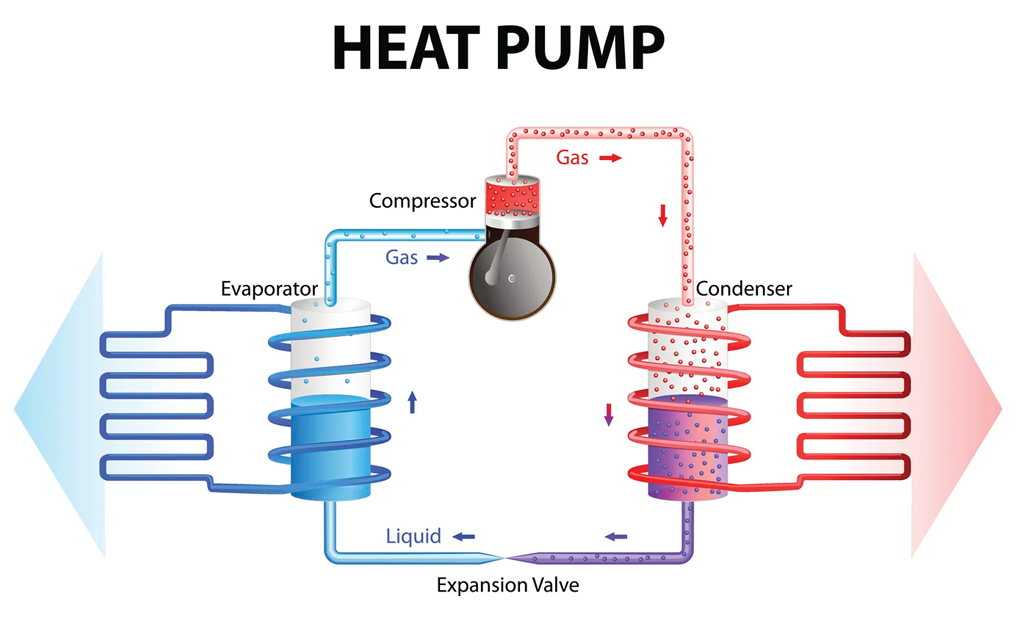

Why a Heat Pump?

There are many reasons to upgrade to an all-electric heat pump:

- It provides year-round comfort

- It doesn’t run on fossil fuels

- It doesn’t produce combustion byproducts

- It can help you save on your energy bill for years

- It may come with up to an $8,000 tax credit (for eligible homeowners who meet IRS requirements)